california renters credit turbotax

Residents of Manitoba who pay rent may be able to receive a credit of up to 20 of rent payments or 700 whichever is less. Exempt property includes most government-owned buildings church-owned parsonages college dormitories and military barracks.

11 States That Give Renters A Tax Credit

File your income tax return.

. To qualify for the CA renters. The taxpayer must be a resident of California for the entire year if filing Form 540 or at least six months if filing Form 540NR as a part-year resident. 60 for single or married filing separately with an adjusted gross income AGI of 40078 or less and.

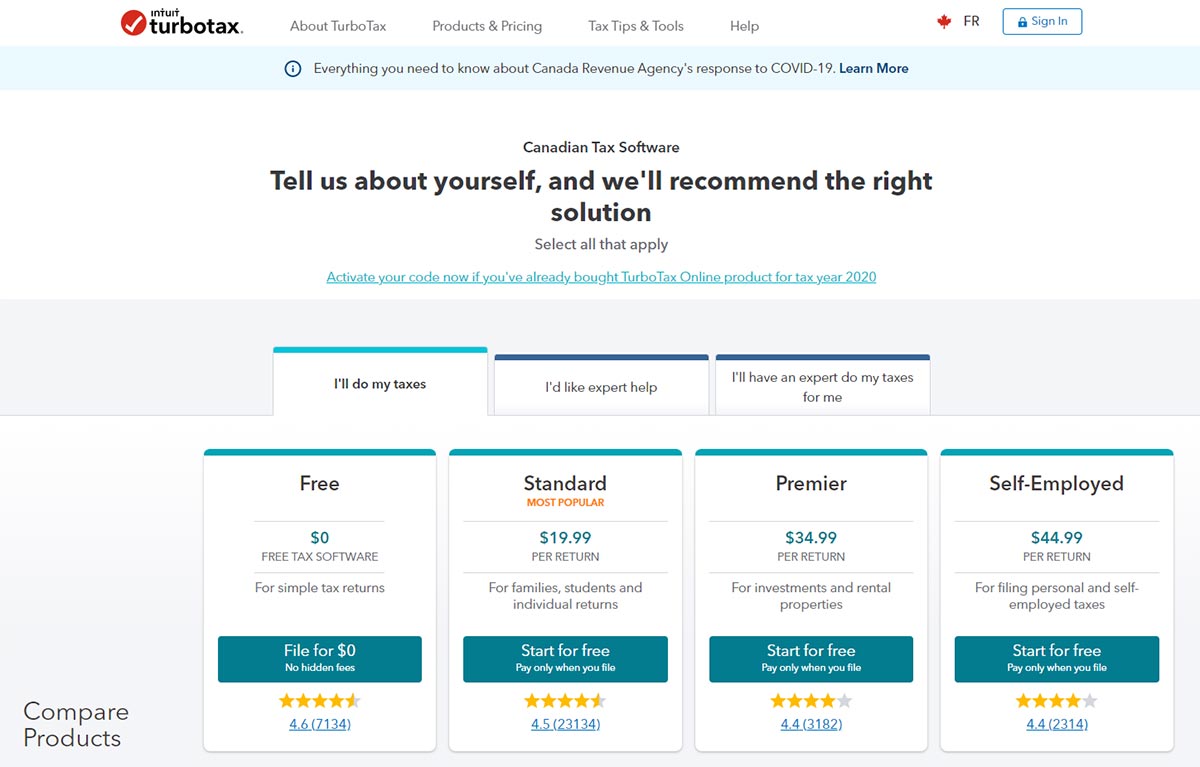

TurboTax will ask you the qualifying questions determine if you qualify and calculate the credit for you. Some people said TurboTax hand holds you a bit better but FreeTaxUsa was just as easy and thorough. Current state law allows a nonrefundable credit for qualified renters in the following amounts for tax year 2017.

I was also pleasantly surprised that they give you the option to import the TurboTax file from. Lacerte will determine the amount of credit based on the tax return information. The 2019 earnings limits are 42932 single and 85864 married.

I have proof of this through the checks written out to my dad. 120 credit if your are. The maximum credit is limited to 2500 per minor child.

A tax credit is a dollar-for-dollar reduction of the income tax you owe. Yes California has a renters credit. Single filers who fall under the earnings cap can get 60 in credit while married filers may be eligible for the 120 max.

Your California income was. California Renters Credit SOLVED by Intuit Lacerte Tax 11 Updated August 20 2021 Use Screen 53013 California Other Credits to enter information for the Renters credit. Check the box Qualified renter.

Hawaii renters who make less than 30000 per year and pay at least 1000 in rent for their. For Single filer it is 60. Calculate your portion of the rent only when filling out the application.

To claim the renters credit for California all of the following criteria must be met. For example if you owe 1000 in federal taxes but are eligible for a 1000 tax credit your net liability drops to zero. FreeTaxUsa was great and you can import TurboTax details.

To claim the California renters credit your income must be less than 40078 if youre single or 80156 if youre filing jointly. Use one of the following forms when filing. Ad Finish Filing Your Taxes w TurboTax And See How Easy It Can Be.

To claim the renters credit for California all of the following criteria must be met. Widower How to claim. I saw a lot of recommendations on this sub for FreeTaxUsa and I was worried at first.

Under the Provincial tab select Provincial Tax Credits Profile then make sure to check the boxes Education Property Tax Credit rent paid and the next box Manitoba School Tax Credit proceed to the next screen which allows for input of your housing information. I dont see anything from the IRS saying there is a limit on how many people in a household can claim this credit. In the California interview look for the section called Renters Credit.

See the California instructions for the worksheet to determine eligibility. You must be a California resident for the tax year youre claiming the renters credit. The taxpayer must be a resident of California for the entire year if filing Form 540 or at least six months if filing Form 540NR as a part-year resident.

Renters Credit Nonrefundable If you paid rent for six months or more on your main home located in California you may qualify to claim the credit on your tax return. File Your Taxes Today. The rent is paid my dad but my brother and me give him money.

To qualify for the Californias Renters Credit you must meet the following. 42932 or less if your filing status is single or marriedregistered domestic partner RDP filing separately. Federal law lacks a credit comparable to the states Renters Credit.

Depending upon the CA main form used the output will appear on Line 46 of the Form 540 or Line 19 of Form 540 2EZ. You rented property for more than half the year that was not exempt from California property tax in 2021. 60 credit if you are.

Neither you nor your spouse if married was granted a homeowners property tax exemption during 2021. A non-refundable credit worth 60 120 for married joint filers that you can apply to your California income tax if you lived in a rental 4. Go to Screen 53 Other Credits and select California Other Credits.

California Renters Tax Credit May Increase to Up to 1000. The property was not tax exempt. Renters earning less than 43533 a year are eligible for a 60 tax credit and renters earning less than 87066 a year who are married.

In California renters who pay rent for at least half the year and make less than a certain amount currently 43533 for single filers and 87066 for married filers may be eligible for a tax credit of 60 or 120 respectively. You paid rent for a minimum of six months for your principal residence. If you are Married Filing Joint the credit is 120.

Manitobas Education Property Tax Credit. An estimated 24 million Californians could see a boost in their tax refunds next year under a. Nonresidents cannot claim this credit.

California Resident Income Tax Return Form 540 line 46. California tenants could get an expanded renters tax credit if Legislature passes bill backed by Democrats and Republicans. It just says you need to have paid rent for half the year and a couple of other things that I meet.

You paid rent in California for at least 12 the year. For more information on Manitobas Education Property Tax Credit see the following links. Some credits such as the earned income credit are refundable which means that you still receive the full amount of the credit even if the credit.

The other eligibility requirements are as follows. You can still qualify for the credit even. To claim the CA renters credit.

1040 California CA California allows a nonrefundable renters credit for certain individuals. Snap A Photo Of Your W-2 And Jumpstart Your Taxes With TurboTax. Renters in California may qualify for up to 120 in tax credits.

Turbotax Review 2022 Pros And Cons

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

What Are Tax Credits Turbotax Tax Tips Videos

Quebec Property Owners Rl 31 Slips And The Solidarity Tax Credit

Turbotax A Review Best Tax Return Software In Canada Insurdinary

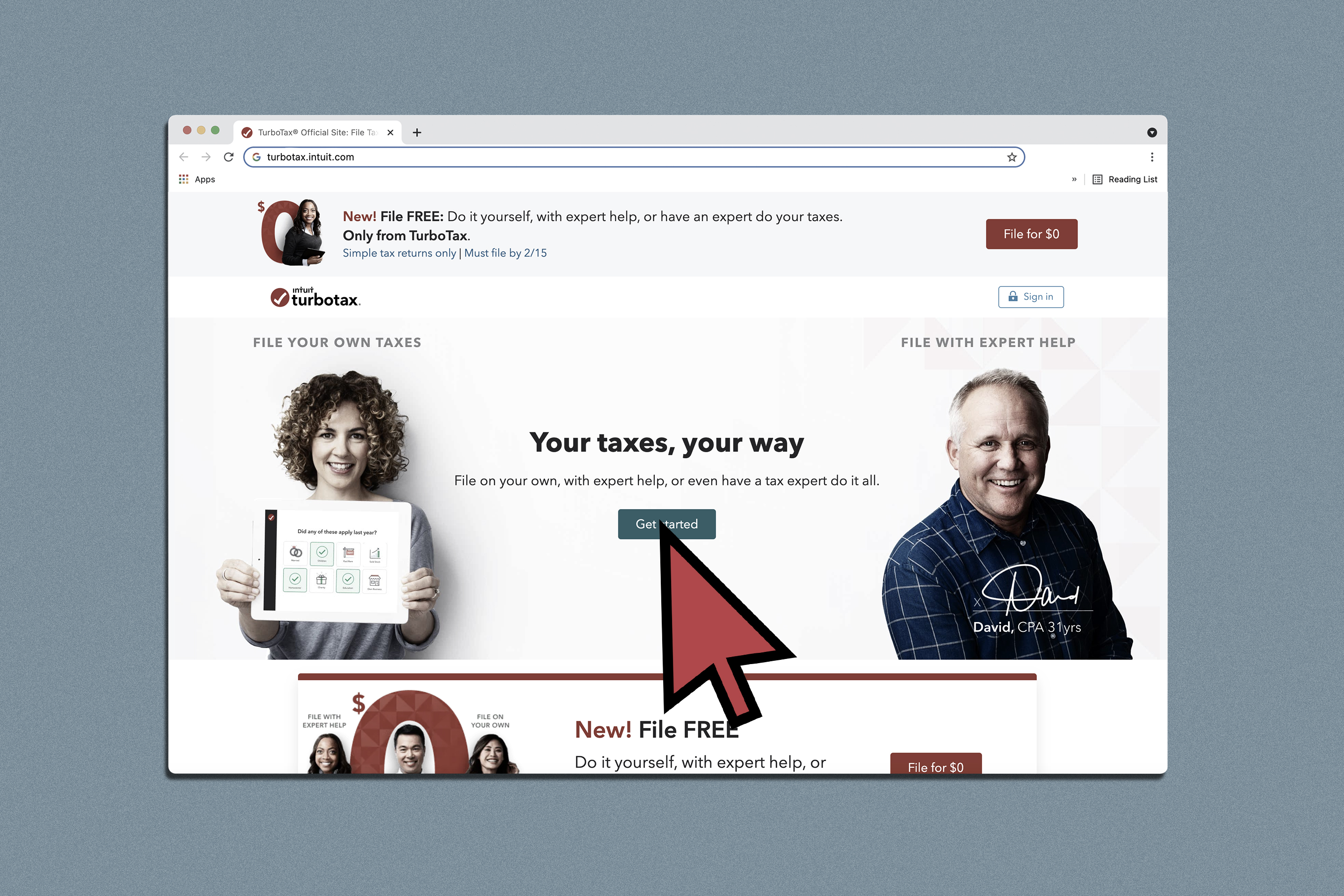

How To File Taxes For Free In 2022 Money

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

What Is The Best Tax Software 2022 Winners

How To File Taxes For Free Turbotax 2022 Free File Change Money

State Slow To Disburse Federal Rental Assistance Tenant Advocates Say Orange County Register

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

Turbotax Review Forbes Advisor

Turbotax Review 2022 Pros And Cons

California Renters Tax Credit May Increase To Up To 1 000 Cpa Practice Advisor